Glossary

One of Capital Lynk’s main goals and objectives is to make your experience with our company enjoyable and our process simple. Our devoted team has put together a list of documents and items that may be required during the funding process and provided you with an explanation and example of each document. We hope that your experience with our company is pleasant.

Remember, you can always call our support team at 1-866-903-5012 and obtain help and assistance, a member of our team is waiting to assist you.

- 4506T Form

- ACH Addendum

- ACH Agreement

- Articles of Incorporation

- Articles of Organization (LLC)

- Balance Transfer Form

- Bank Letter Confirming your Banking Information

- Bank Transaction History for Current Month’s Transactions

- Bridge Account form

- Clear Title

- Competitor’s Contracts and/or Funding Offers

- Confession of Judgment

- Copy of a Utility Bill

- Copy of Business Lease

- Copy of Business License

- Copy of Drivers License

- Copy of Liquor License

- Copy of Passport

- Copy of Rent Checks

- Copy of Void Check

- Corp Resolution / Board of Directors

- Corporate Tax Return – All Pages from your Most Recent Filing

- Corporate Tax Return – Page 1 Only from your Most Recent Filing

- Current Lender’s Statement

- Documentation Related to the Following Judgment(s)

- EIN Form

- IRS Letter

- K-1 Schedule (Most Recent Corporate Tax Return)

- Lien Termination Letter

- MCA Agreement

- Member Certificate for LLC

- Merchant Processing Application

- Merchant Processing Document

- Merchant Processing Rate Analysis

- Merchant Processing Split Form

- Merchant Processing Termination Letter

- Merchant Processing Loaner Form

- Merchant Processing Next Day Settlement Form

- Merchant Equipment / POS Related Document

- Mortgage Statement

- Online Access for your Business Bank Account

- Online Access for your Merchant Processing Account

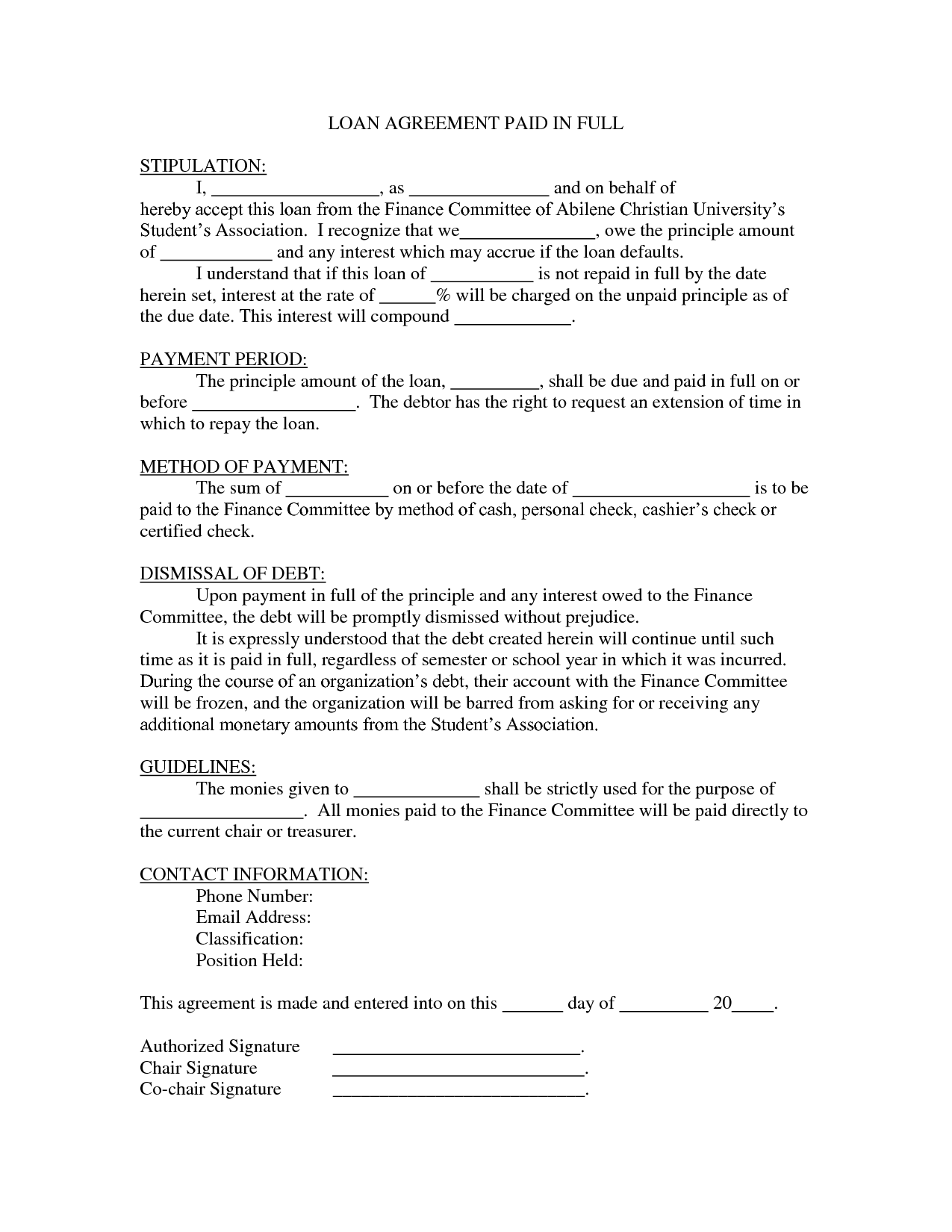

- Paid in Full Letter from your Previous Provider

- Payoff Letter from your Current Provider

- PCI Compliance

- Permission to Release

- Professional Fees

- Tax Lien Payment Plan and/or Documentation Related To

- Working Capital Application

- YTD Financials (Include Profit & Loss and Balance Sheet)

- Other Documents

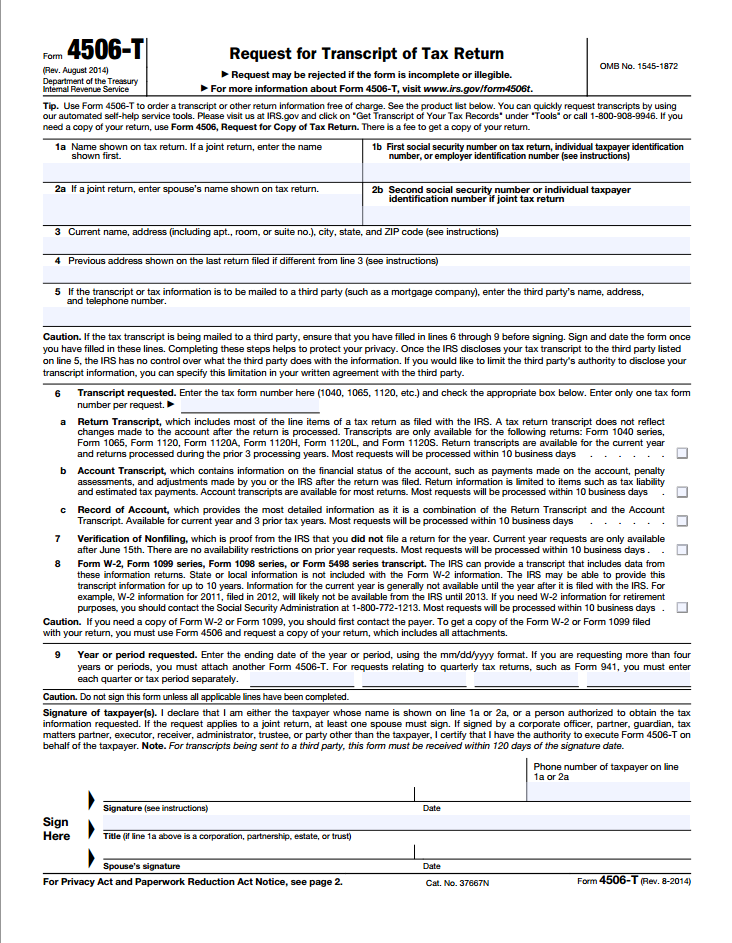

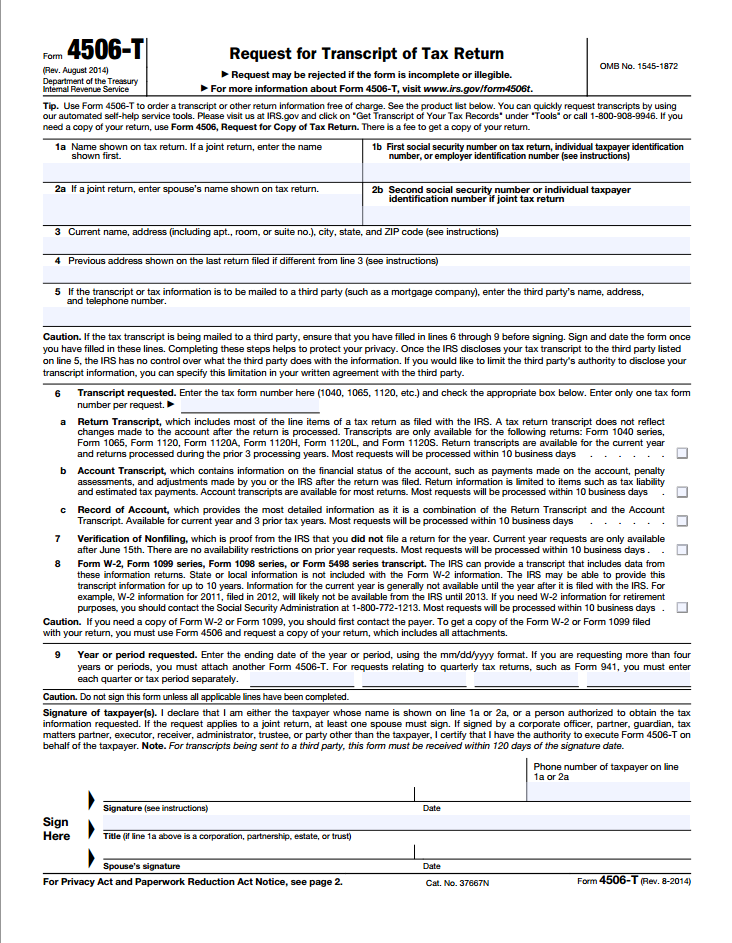

4506T Form

This document allows us to obtain a copy of your most recent corporate tax filing.

ACH Addendum

The Ach Addendum is a document that you sign which allows us to debit your business bank account the daily/weekly repayment amount. We need to present this document to our bank to initiate debits out of your business bank account.

ACH Agreement

Please review your ACH Agreement. Your funded amount, payback amount and fixed payment are listed on page 1 of the agreement. You need to sign and initial where indicated. Please make sure to send us back all pages, even the ones with no signatures and/or initials. Please keep a copy of those documents for your records.

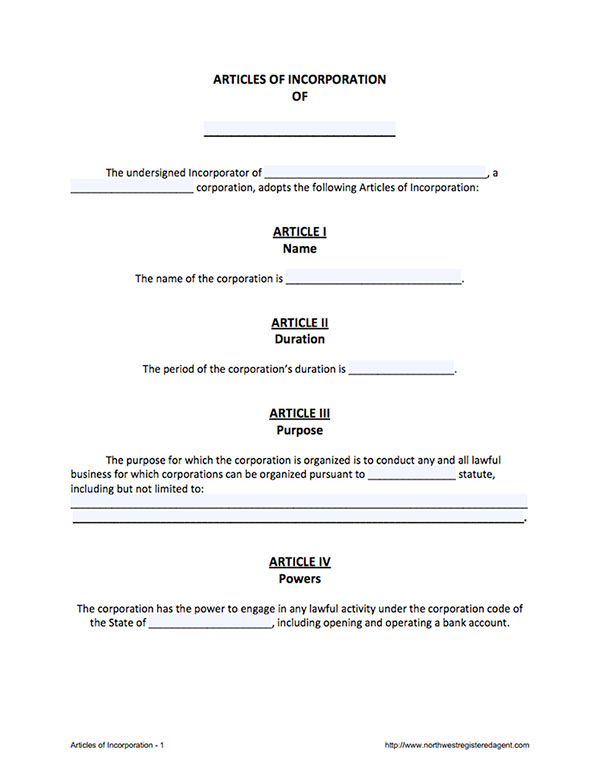

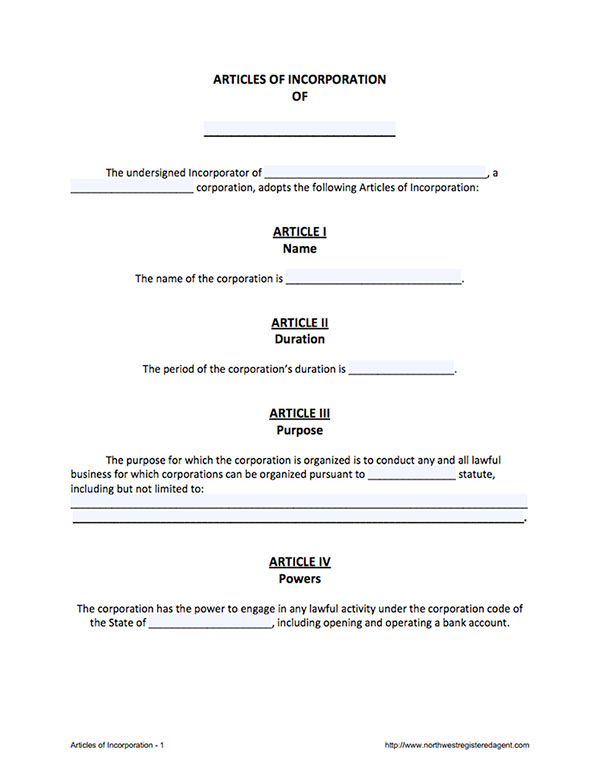

Articles of Incorporation

Please provide a legible copy of the Articles of Incorporation for your business. They were filed with the state or other regulatory agency when you formed your corporation. They list the primary rules governing the management of your corporation.

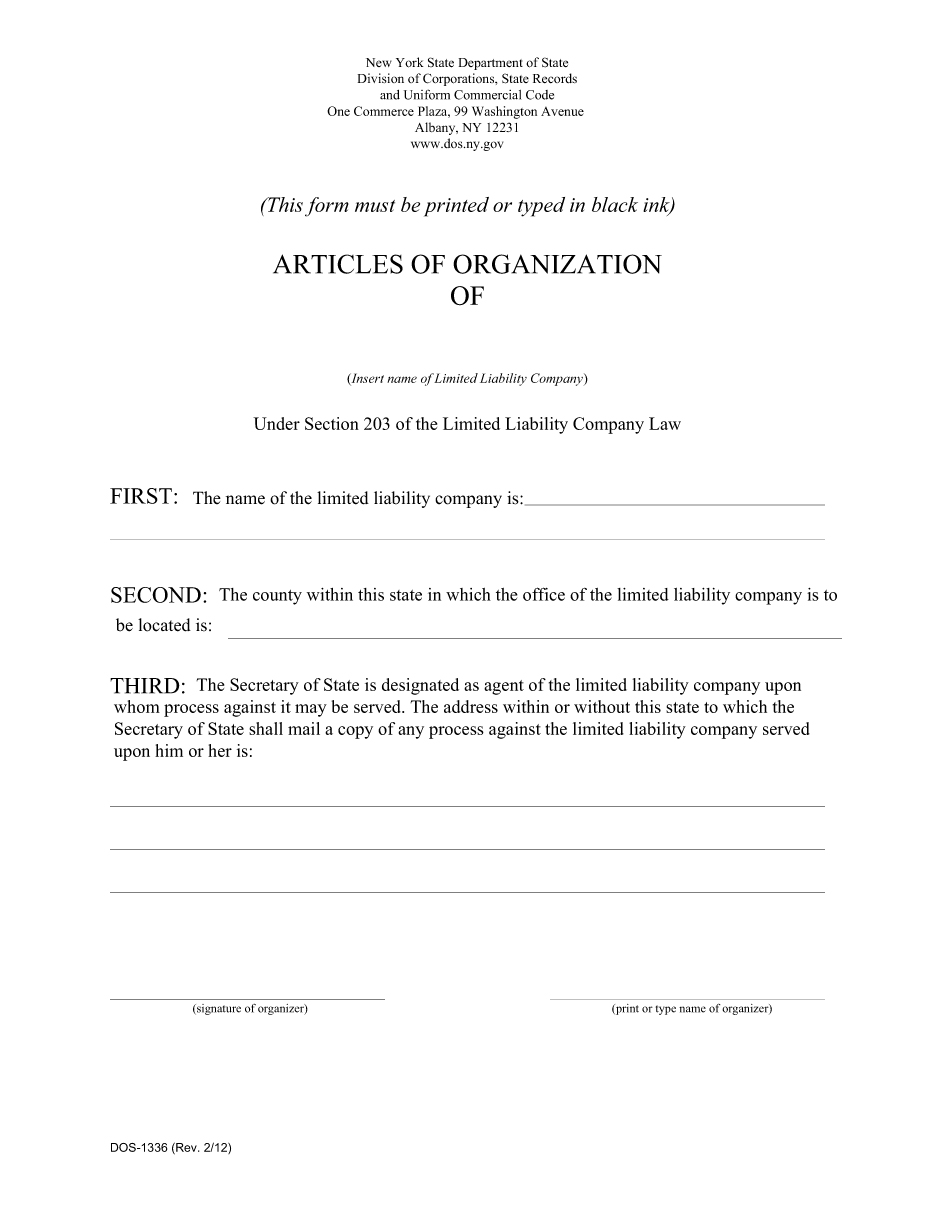

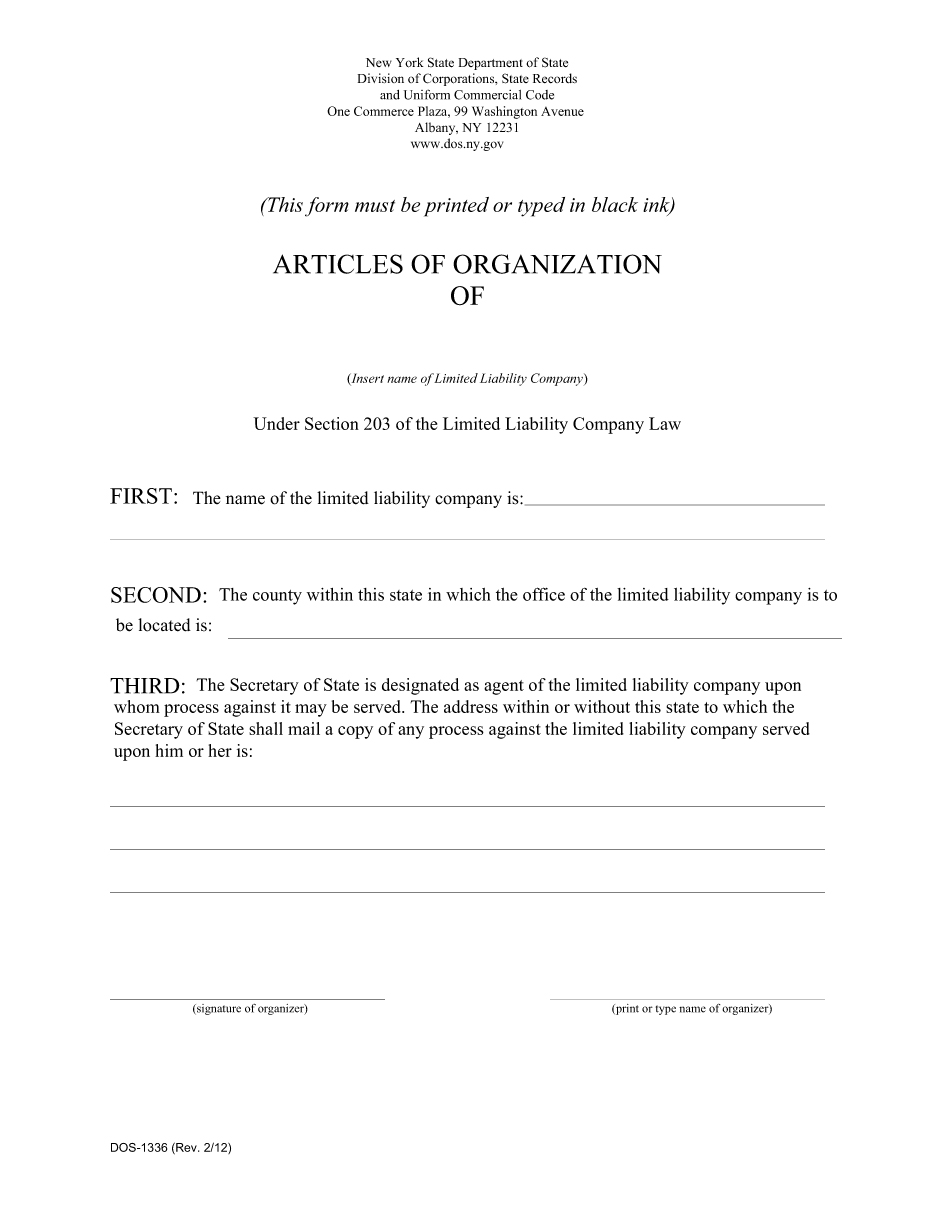

Articles of Organization (LLC)

Please provide a legible copy of the Articles of Organization for your LLC. They were filed with the state or other regulatory agency when you formed your LLC. They list the primary rules governing the management of a corporation.

Balance Transfer Form

The balance transfer form is a document we need you to sign allowing us to transfer your open contract balance onto your new contract.

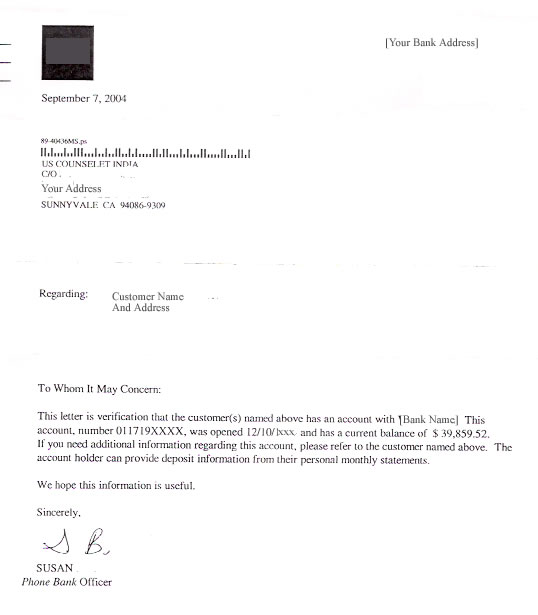

Bank Letter Confirming your Banking Information

Please provide an official letter from your bank with your new banking information. The letter must clearly list your business name, routing number and account number. It should also have the name and phone number of an individual at the bank we can call to confirm. We require bank letters if you do not have a void check for your business account.

Bank Transaction History for Current Month’s Transactions

Prior to releasing funding, we need to review your most recent bank activity. Please provide your banking transaction history for the current month’s transaction; from the 1st of the month up to today (you can download this online from your online banking and email or fax it to us).

Bridge Account Form

Please complete the Bridge account form. This document allows us to open a bank account for your business in which your credit card processor will deposits your daily batches directly. We will then hold the percentage (%) of credit card sales we agreed on and apply it towards your contract balance and send to your business bank account the remaining balance owed. That means that instead of getting your deposits directly from your credit card processor, we will be sending you your deposits from the Bridge Account, minus our percentage. Please note that we will provide you with a monthly statement and also access to our online portal, where you can view transactions in the bridge account in real time.

Clear Title

Please provide us with a document showing that the business property is free and clear of any form of debt.

Competitor’s Contracts and/or Funding Offers

Please provide us with a copy of your current and/or previous funding contract. The document should list the terms of your funding (funded and payback amount, payment % and term). If you haven’t obtained funding yet from the provider, please send us a copy of the contract offer so we can review it. Our policy is very simple, we will beat any offer that is presented to us in writing.

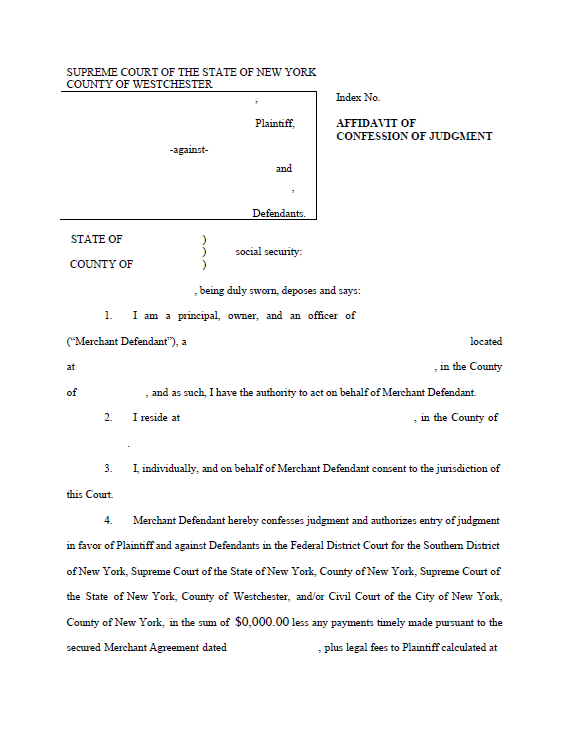

Confession of Judgment

This document is requested prior to funding, it allows our legal team to proceed with a judgment against the business and/or borrower in the event that the funding contract defaults.

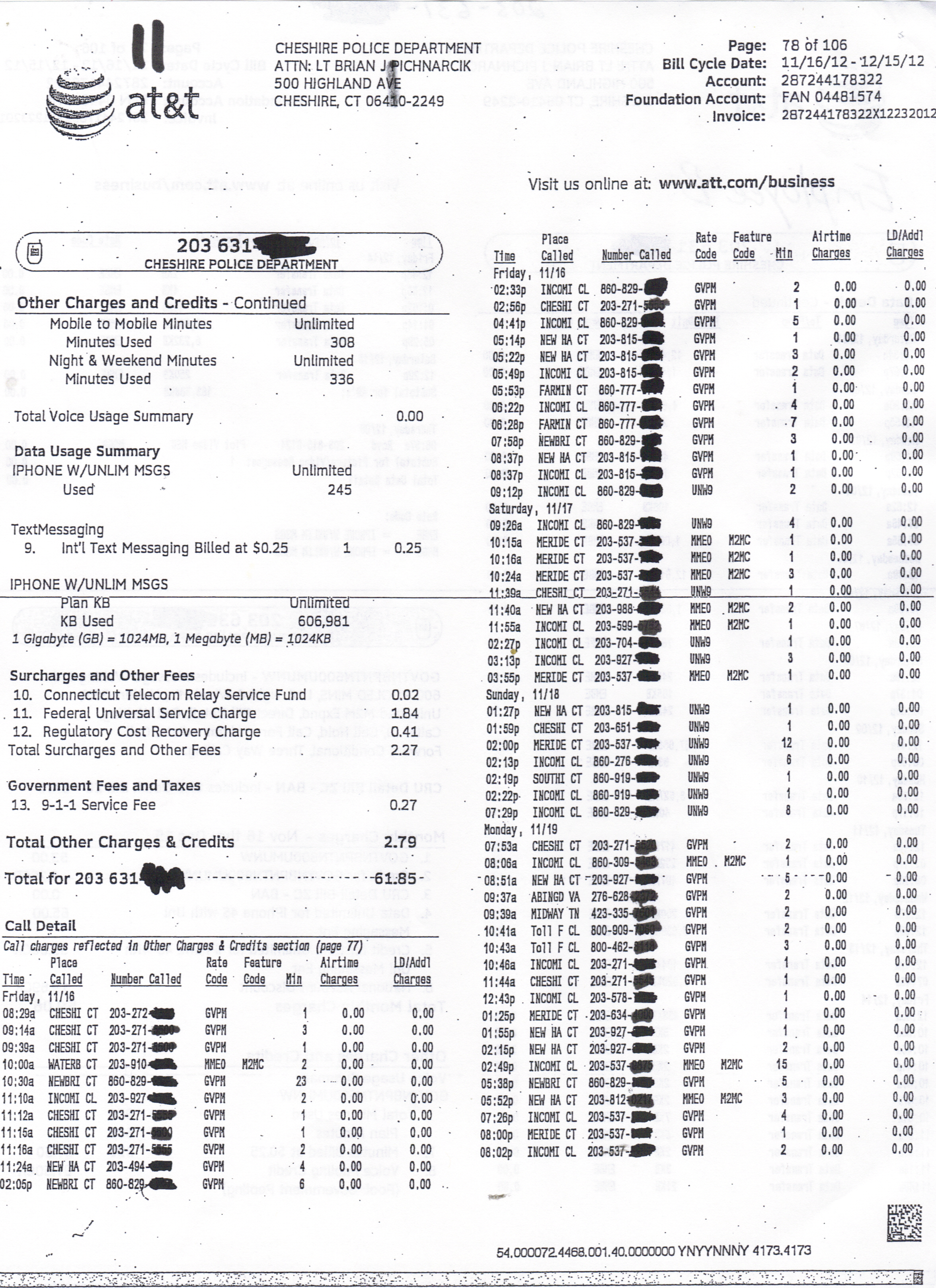

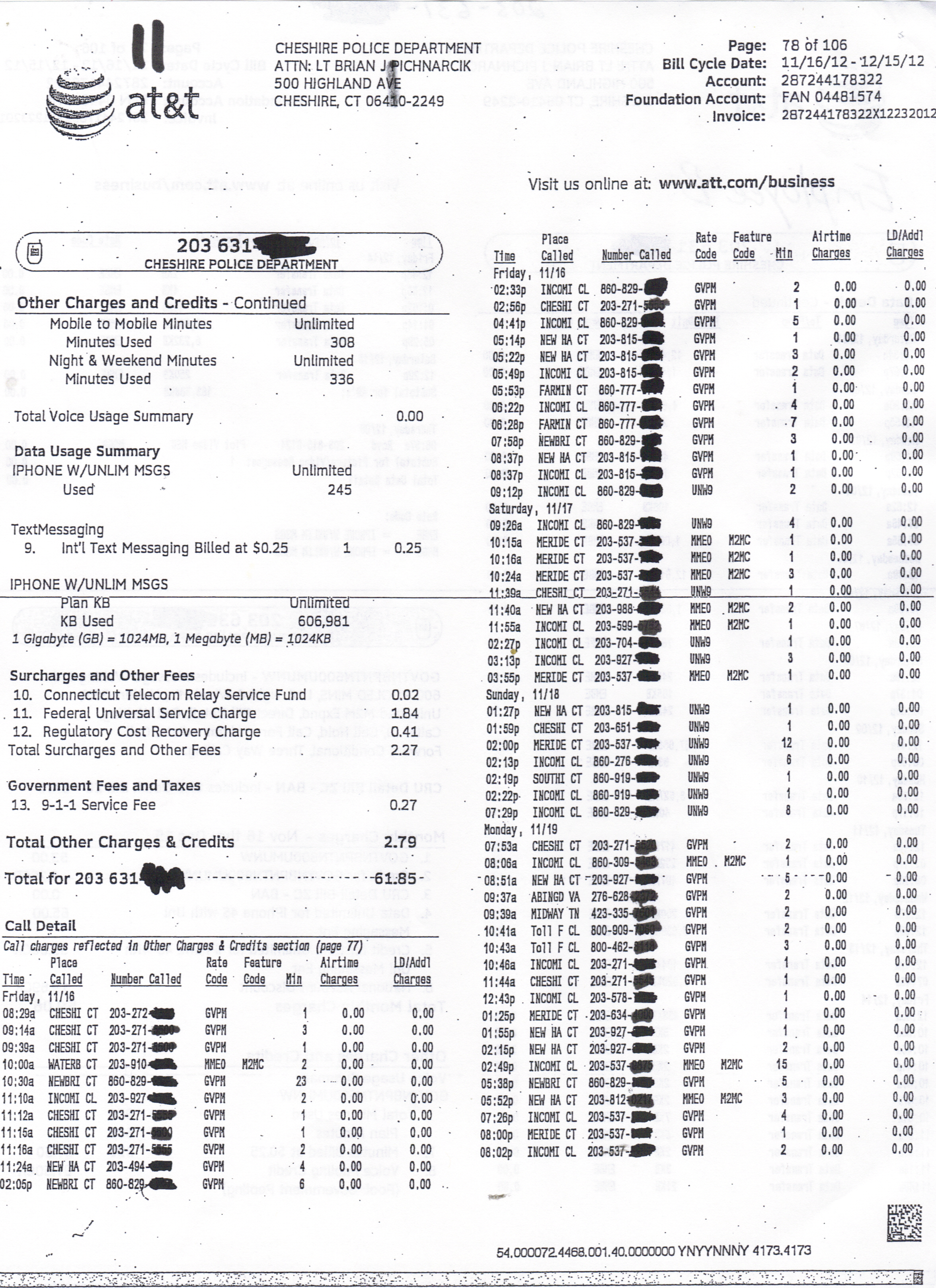

Copy of a Utility Bill

Please provide us with a copy of a personal utility bill. The bill should include the business owner’s name and personal address. We accept cell phone bills, electric bills, credit card statements, department store cards and many others…

Copy of Business Lease

Please provide us with a copy of the business lease for your current location. We understand that some leases contain lots of pages. We simply need the pages that list the start and end date of the lease agreement, the monthly rent payment, renewal options if any and we need signature pages of all parties involved.

Copy of Business License

Please provide us with a copy of a Business License. The document should list the business legal and/or DBA name on it, business address and sometimes owners name. The document also needs to be active, we do not accept expired business licenses. You can send us a picture with your smart phone or fax us a copy.

Copy of Drivers License

Please provide us with a legible copy of each business owner’s license. You can take a picture of the document with your Smartphone and email it to us. Please note that the drivers license must not be expired and we should be able to clearly see the owners full name, address, picture and signature.

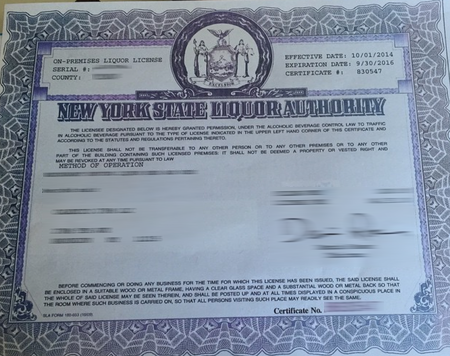

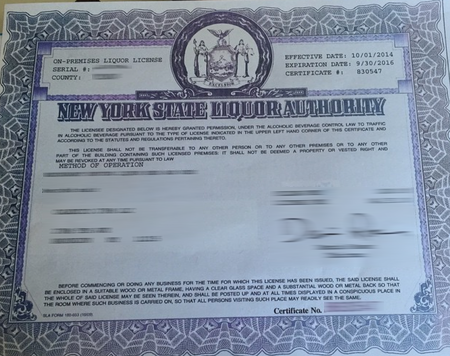

Copy of Liquor License

Please provide us with a copy of your Liquor License. The document should list the business legal and/or DBA name on it, business address and sometimes owners name. The document also needs to be active, we do not accept expired liquor licenses. You can send us a picture of it, or fax us a copy.

Copy of Passport

Please provide us with a legible copy of the business owners Passport. The document must be valid, we do not accept expired documents. You can take a picture of the document with your Smartphone and email it to us.

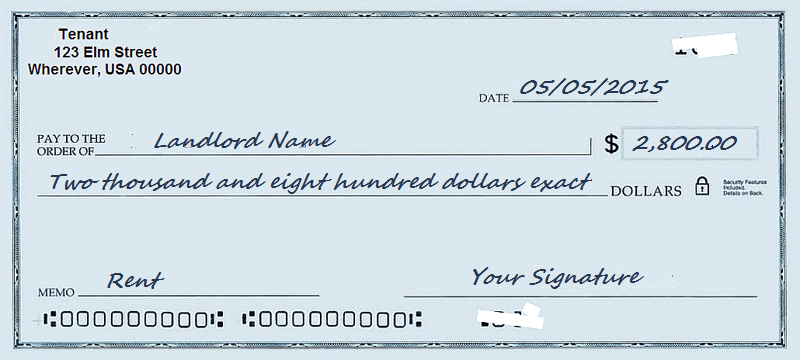

Copy of Rent checks

Please provide us with copies of your rent payment on your business lease. You can download these checks online directly from your bank’s website. Or, instead, you can also supply us with a copy of a rent statement from your landlord. We need to confirm that your business is current on its rent payment.

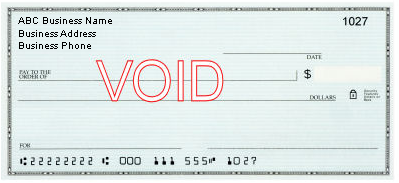

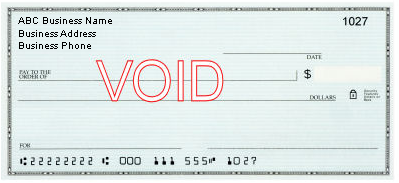

Copy of Void Check

The copy of the void check must include your business name, routing number and account number on it. Please note that we do not accept starter checks. If you do not have a void check, you will need to send us a bank letter.

Corp Resolution / Board of Directors

The corporate resolution or Board of directors is a document signed by the business owner attesting he is the owner of the business and has the capacity to sign on behalf of the business.

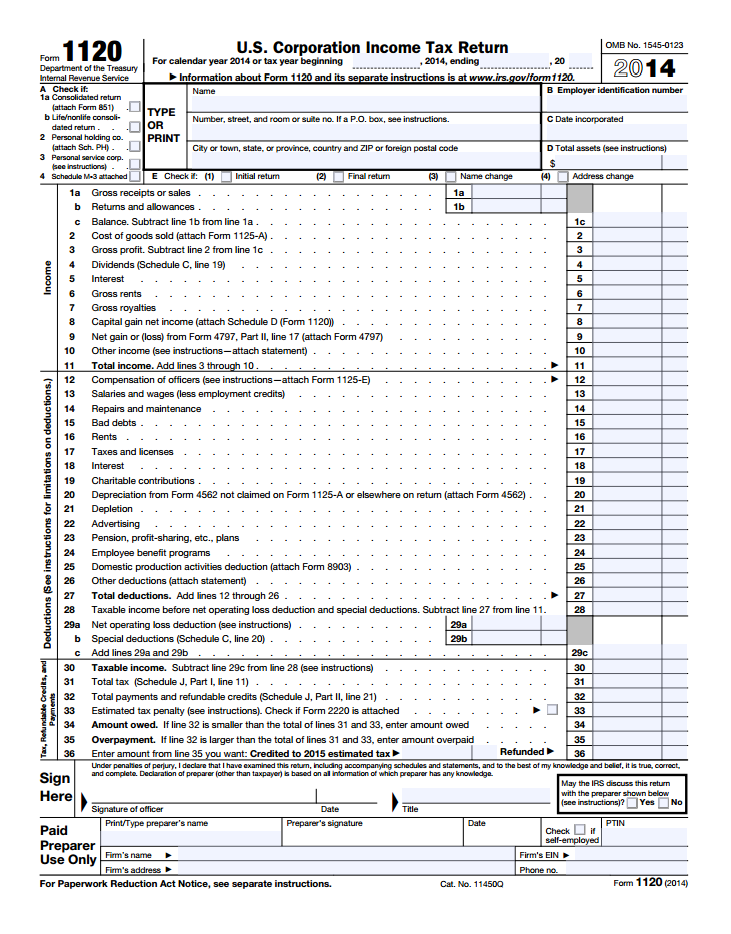

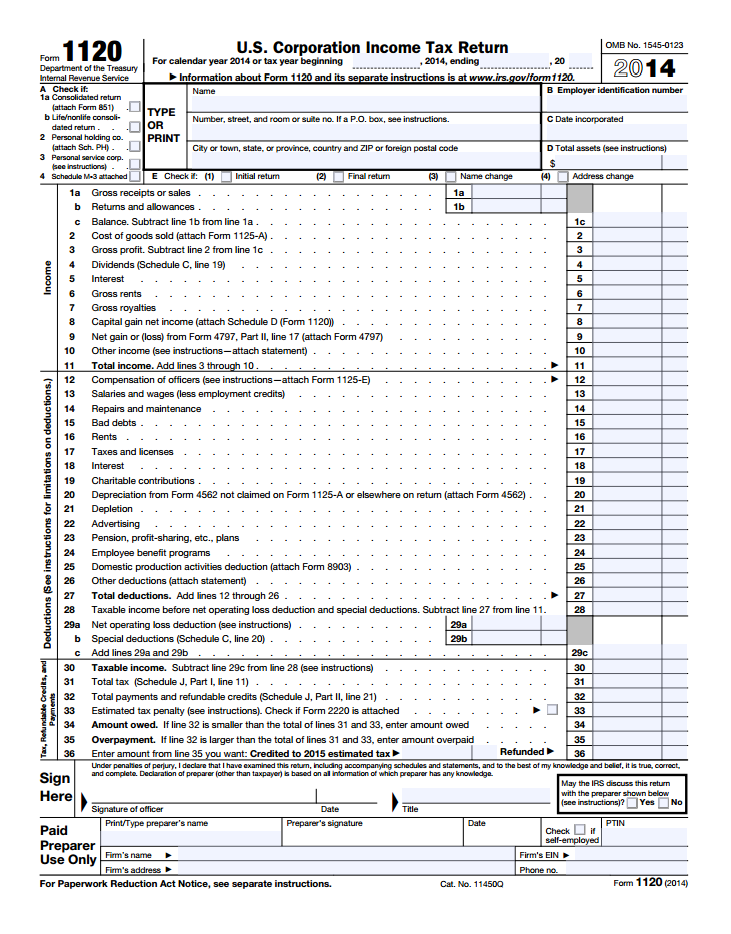

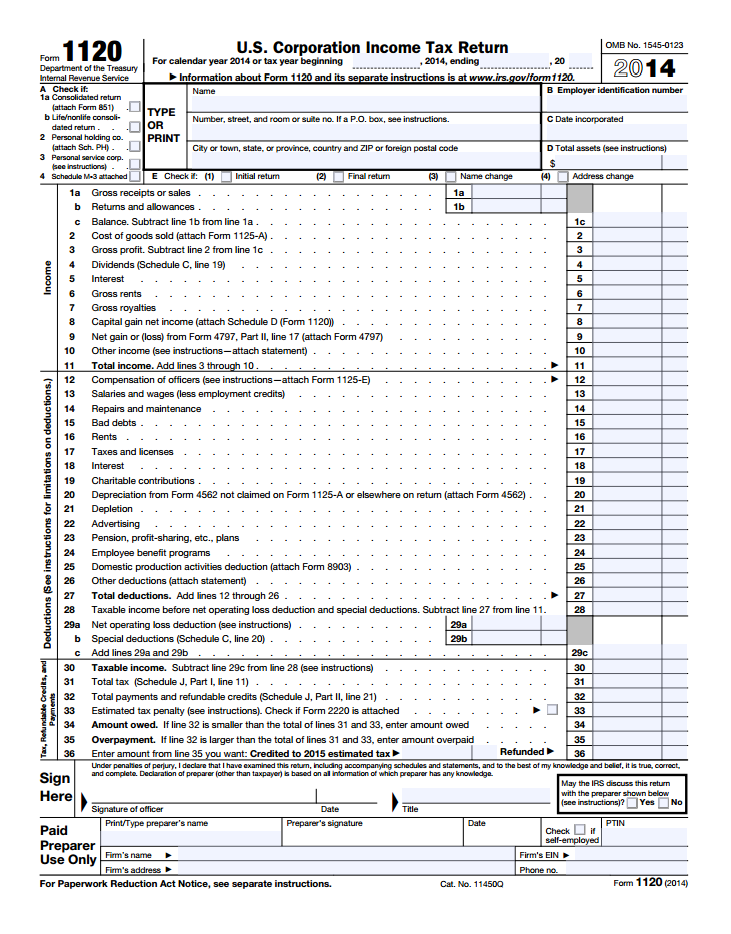

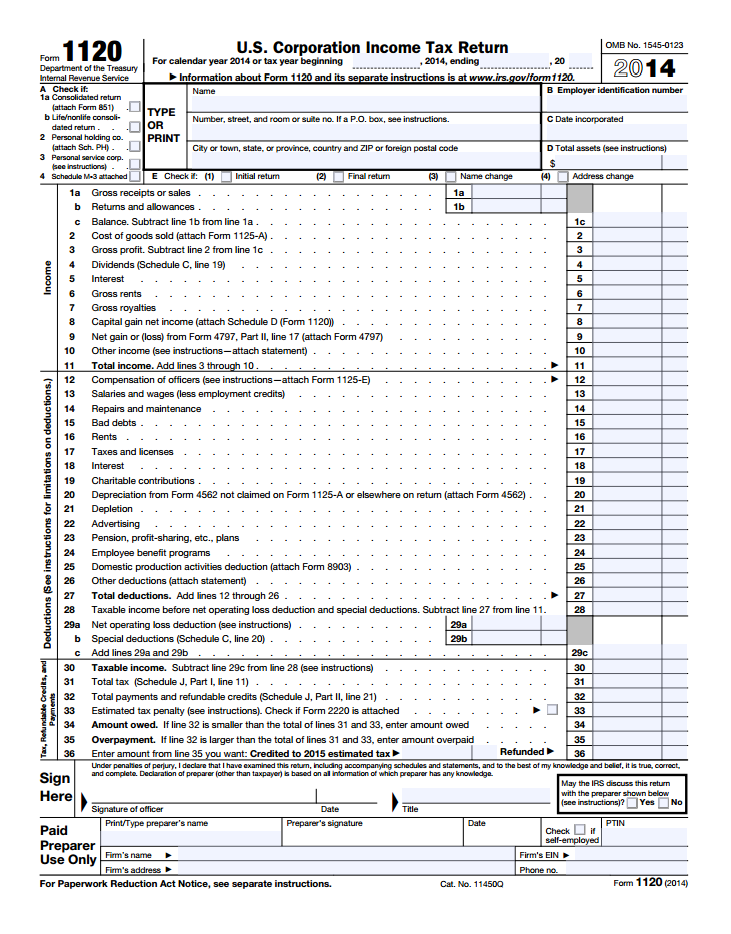

Corporate Tax Return – Include All Pages from your Most Recent Filing

Please provide us with a copy of your most recent corporate tax return. This document includes multiple pages that included your business name, business address, officers and/or owners name, share distribution, gross annual sales, revenue, profits and detailed financial report. We will need to review this document for your business.

Corporate Tax Return – Page 1 Only of your Most Recent Filing

Please provide us with a copy of Page 1 only of your most recent corporate tax return. This page includes your business name, business address, gross annual sales and revenue. We will need to review this document for your business.

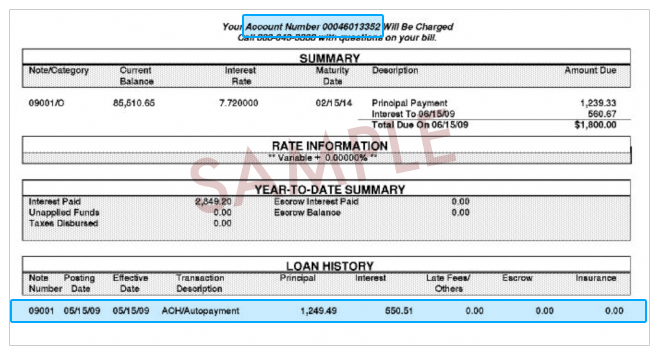

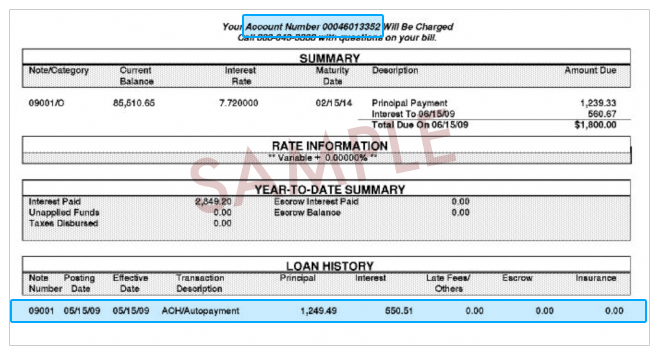

Current Lender’s Statement

Please provide an activity statement from your previous advance with your provider. It should include your business name, merchant number and list a breakdown of payments made towards your advance.

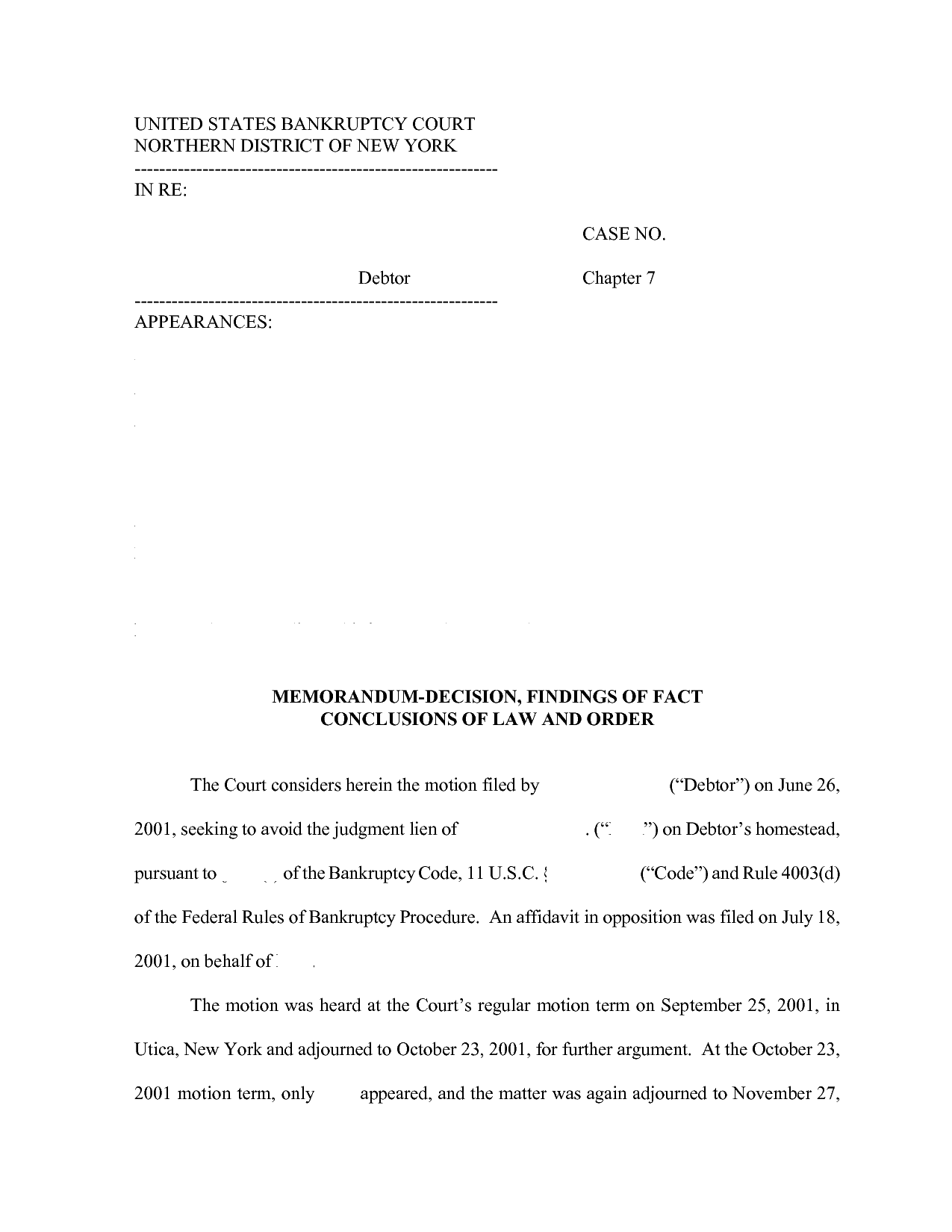

Documentation Related to the Following Judgment(s)

Please provide us with any documents you have in regards to the judgment(s) listed. If you are working on it, provide us with an explanation.

EIN Form

An official letter from the IRS. The letter should include the business name, address and federal identification letter.

IRS Letter

Any official letter or mail correspondence from the IRS. The letter should include the business name, address and federal identification letter.

K-1 Schedule (Most Recent Corporate Tax Return)

One of the many pages of your corporate tax return is called K-1 Schedule. This page lists all owners of the business and their share percentage (%). We need to review this document to ensure we have included all owners of the business. Please note that if you operate a sole-proprietorship or a single member LLC, the document we require is called a Schedule C.

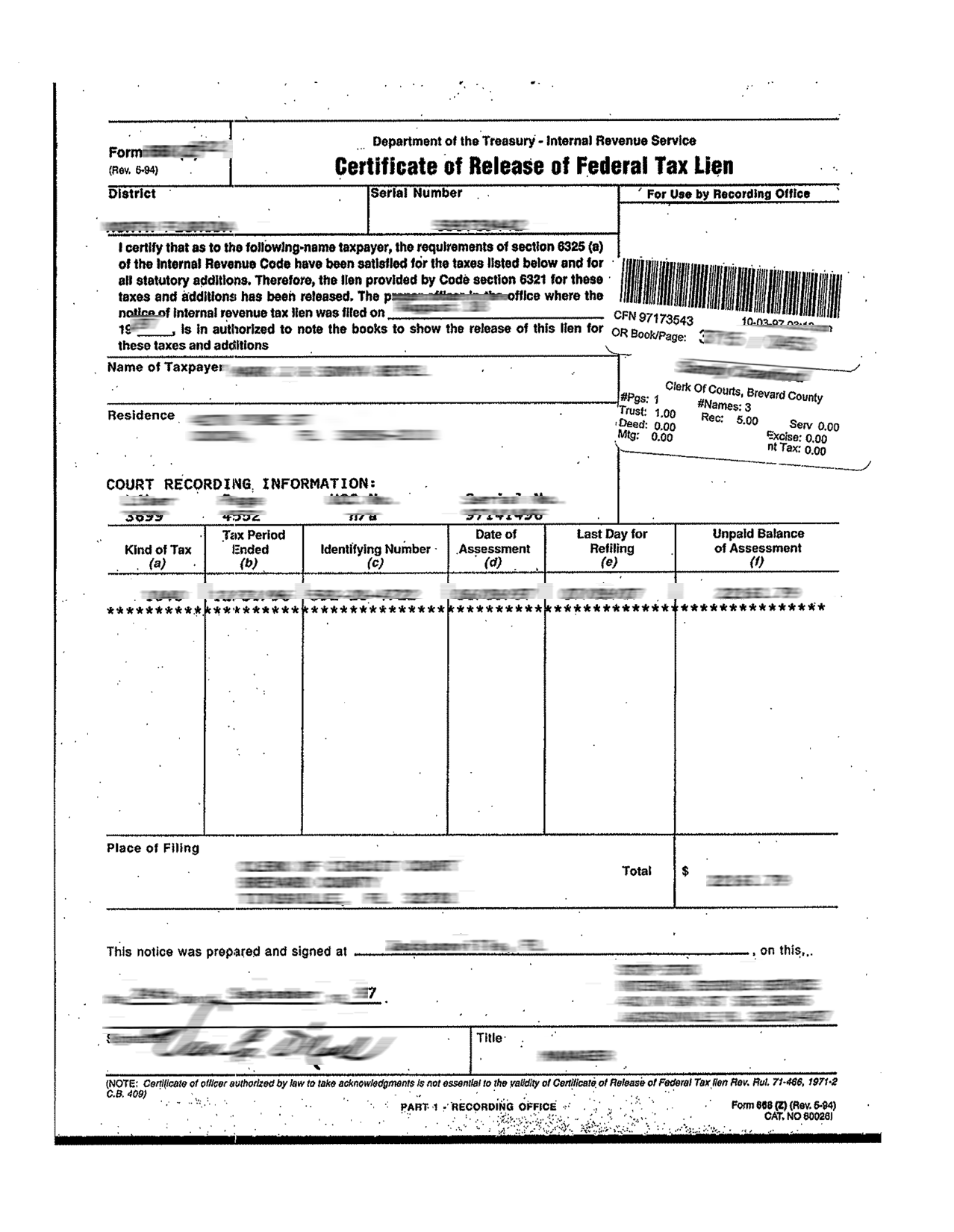

Lien Termination Letter

Please provide us with a copy of a Lien Termination. If the lien is still active, you need to contact the party that filed the lien and ask them to terminate it and send you a copy. Please note that in many cases, companies do not terminate liens automatically, they require a verbal or written demand from the borrower.

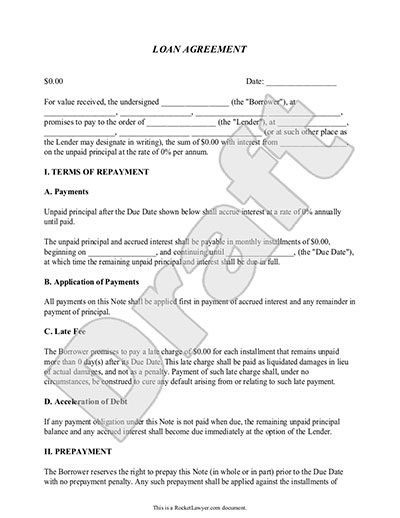

MCA Agreement

Please review your Merchant Cash Advance Agreement. Your funded amount, payback amount and holdback percentage (%) are listed on page 1 of the agreement. You need to sign and initial where indicated. Please make sure to send us back all pages, even the ones with no signatures and/or initials. Please keep a copy of those documents for your records.

Member Certificate for LLC

The member certificate for LLC is a document signed by the business owner attesting he is a member of the LLC and is authorized to sign on behalf of the business.

Merchant Processing Application

Please complete your merchant account application. This will allow us to set up a new merchant account for your business to accept credit card sales with.

Merchant Processing Document

This document is related to your new merchant account set up.

Merchant Processing Rate Analysis

Please review our rate analysis, it lists your current processing fees with your processor in each of the interchange categories. Our proposed rates are also presented on the analysis and savings for each interchange category.

Merchant Processing Split Form

This form indicates that you agree to pay the agreed percentage of payments to the lender pursuant to the Merchant Agreement. This form instructs your processor to withhold or debit the agreed percentage of credit card payments until such time as the lender notifies your professor that your obligations under the Merchant Agreement have been satisfied.

Merchant Processing Termination Letter

Please contact your current and/or previous merchant processor and request a Termination Letter from them. We need to ensure that your merchant account with them has been closed/terminated. This letter is required to ensure that your business is only operating one active merchant account, which is an important condition of our Merchant Cash Advance program.

Merchant Processing Loaner Form

In order to obtain a loaner terminal from our merchant processing department, we need you to complete this form. Please note that if you decide to stop processing with our company, you will need to return the loaner terminal. In order to obtain a loaner terminal from our merchant processing department, we need you to complete this form. Please note that if you decide to stop processing with our company, you will need to return the loaner terminal.

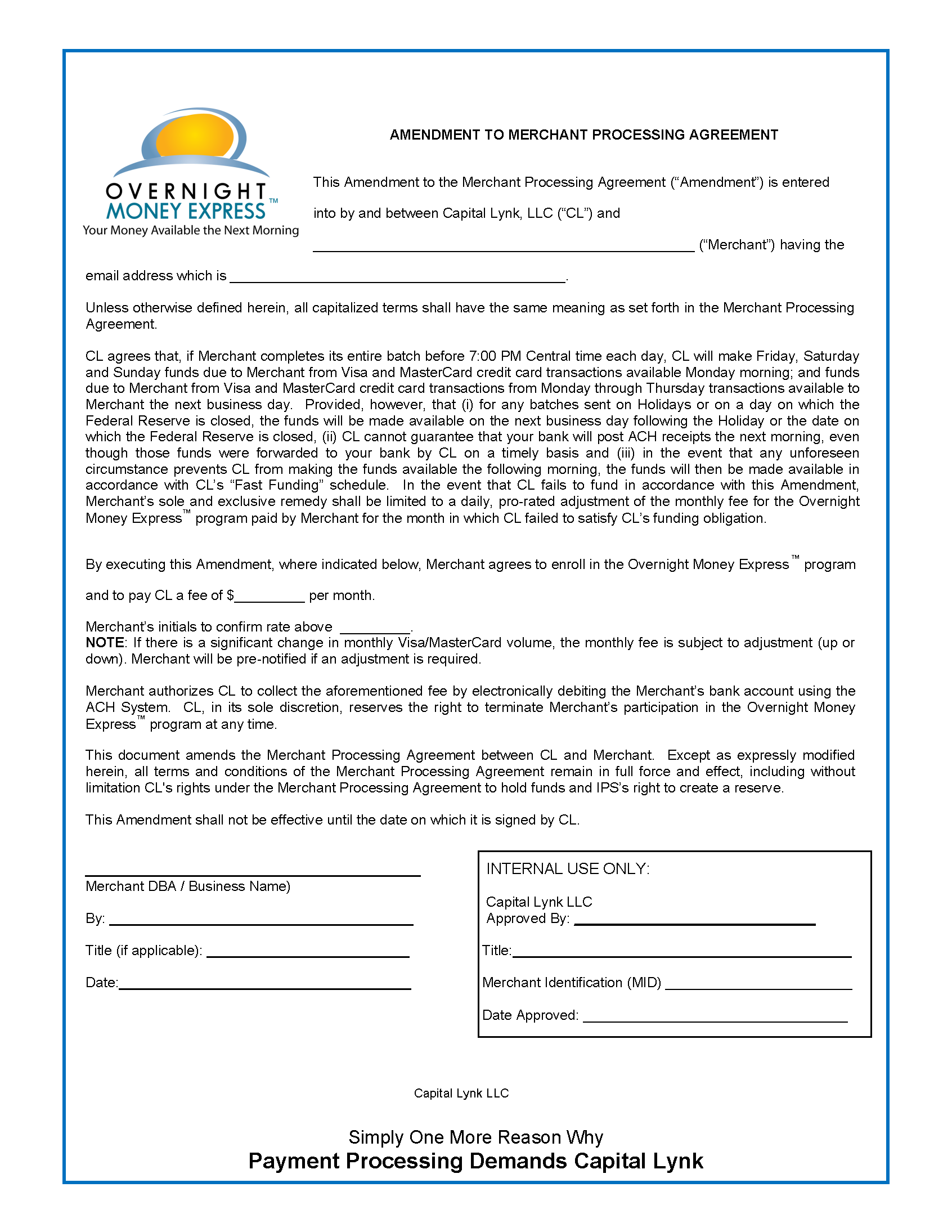

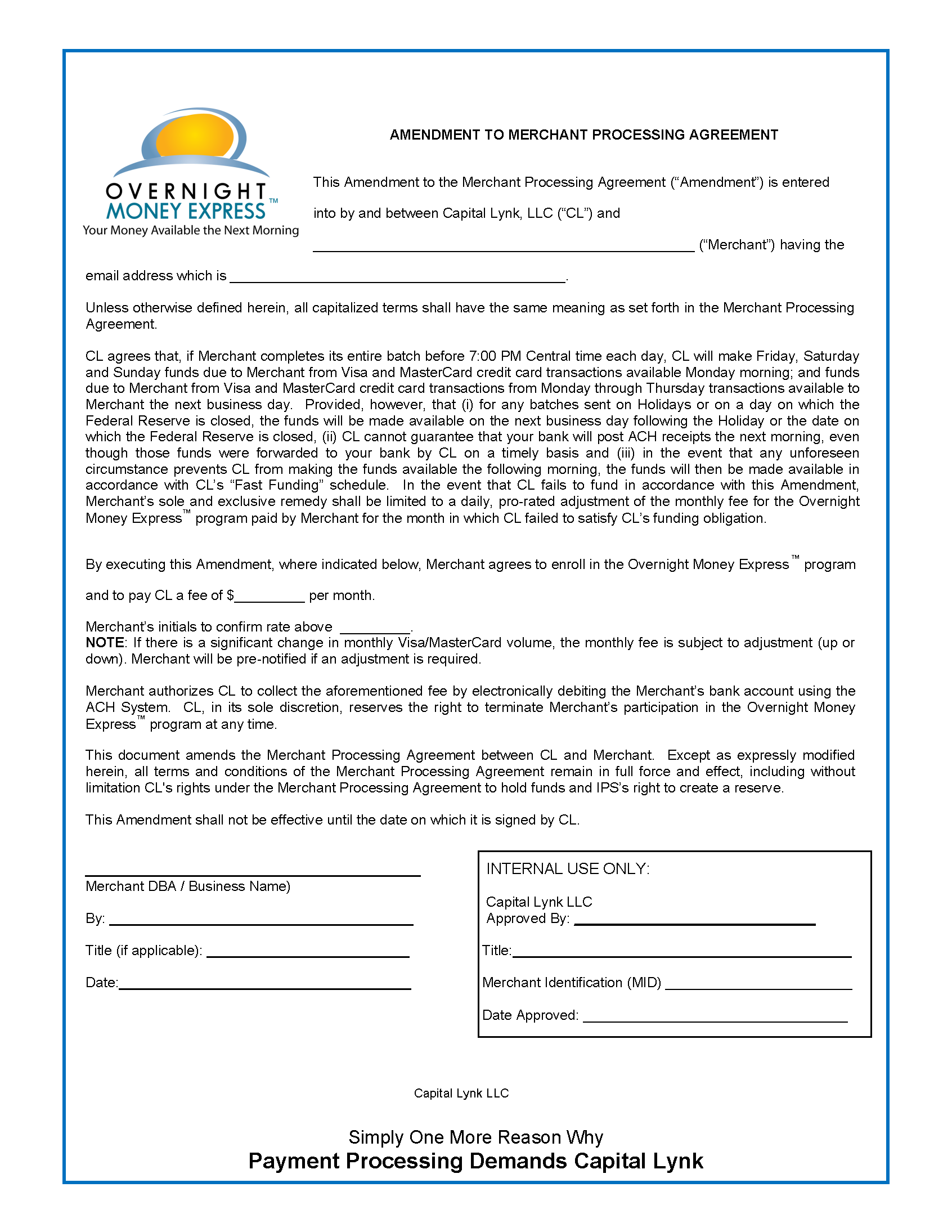

Merchant Processing Next Day Settlement Form

By signing this form, you will be receiving your credit card settlements the next day. That means if you close your credit card batches daily, the next morning, funds will be transferred to your business bank account.

Merchant Equipment / POS Related Document

This document is related to your new merchant account and equipment (hardware/software).

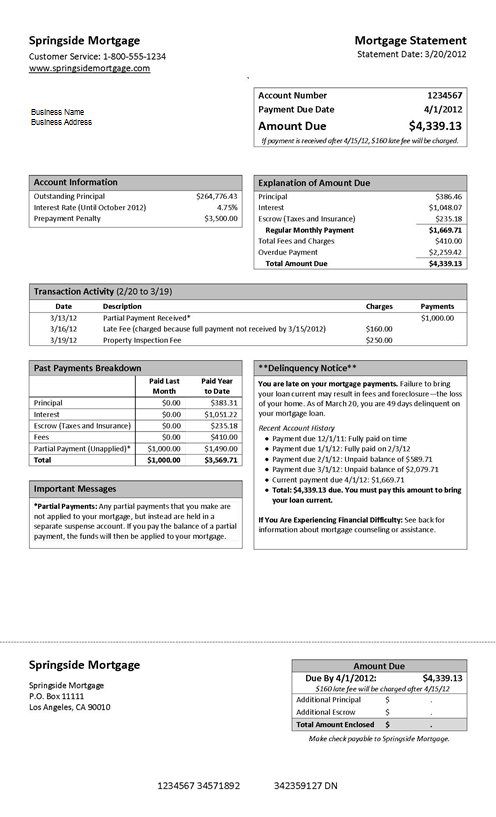

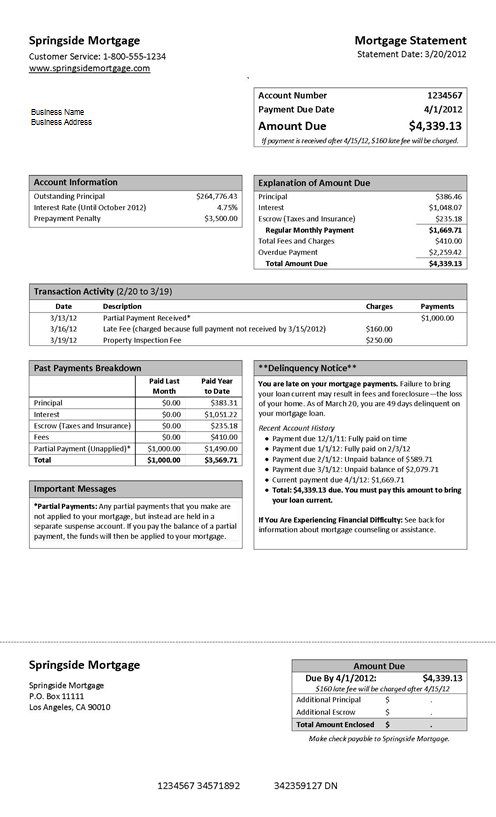

Mortgage Statement

Please provide us with your most recent mortgage statement for your business property. We would like it to include the address of the property, the name of the mortgage holder, the name of the debtor and the term of the mortgage, if possible. We need to confirm that your business is in good standing on its mortgage.

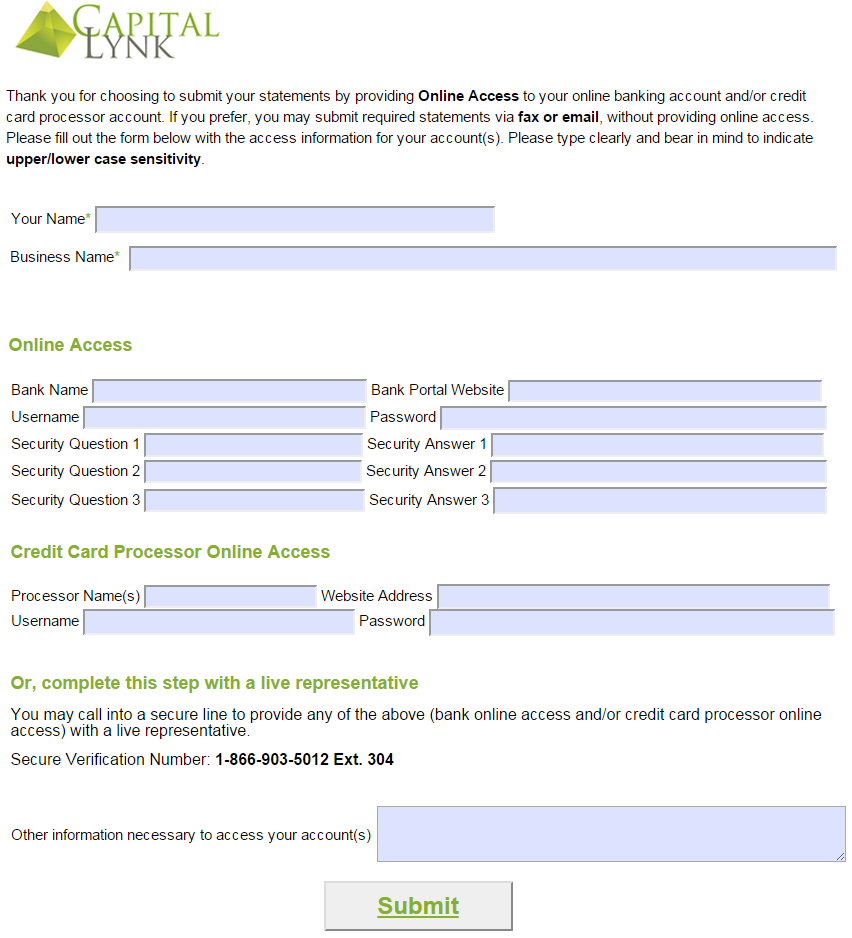

Online Access for your Business Bank Account

To Share your Online Access: Click Here.

Please provide us with online access to your business bank account. We will need the bank’s website address, your user name and password as well as any other security parameters needed to access the account online (security questions and answers, codes etc…) Please note that we do not share your online information with any third party and that you are required to change your password after we have verified your banking information. We request to review your account online to validate that your business account is active, that the information online matches the statements provided to us. We may also review gross deposits and seasonality. You can also use Decision Logic, which allows us to confirm your account without having you share your online access with us.

Click here to complete Decision Logic.

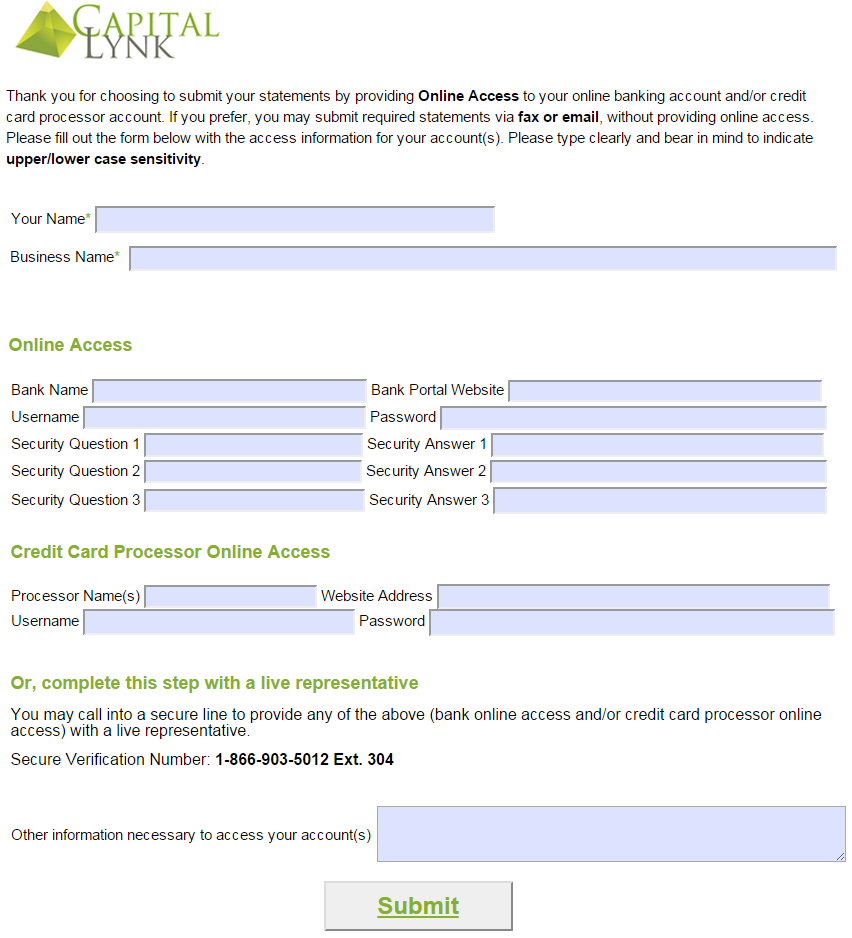

Online Access for your Merchant Processing Account

To Share your Online Access: Click Here.

Please provide us with online access to your merchant account. We will need your processor’s website address, your username and password, as well as any other security parameters needed to access the account online (security questions and answers, codes, etc.). Please note that we do not share your online information with any third party and that you are required to change your password after we have verified and downloaded your credit card statements. We request to obtain your online access to download statements directly and speed up the approval/funding process.

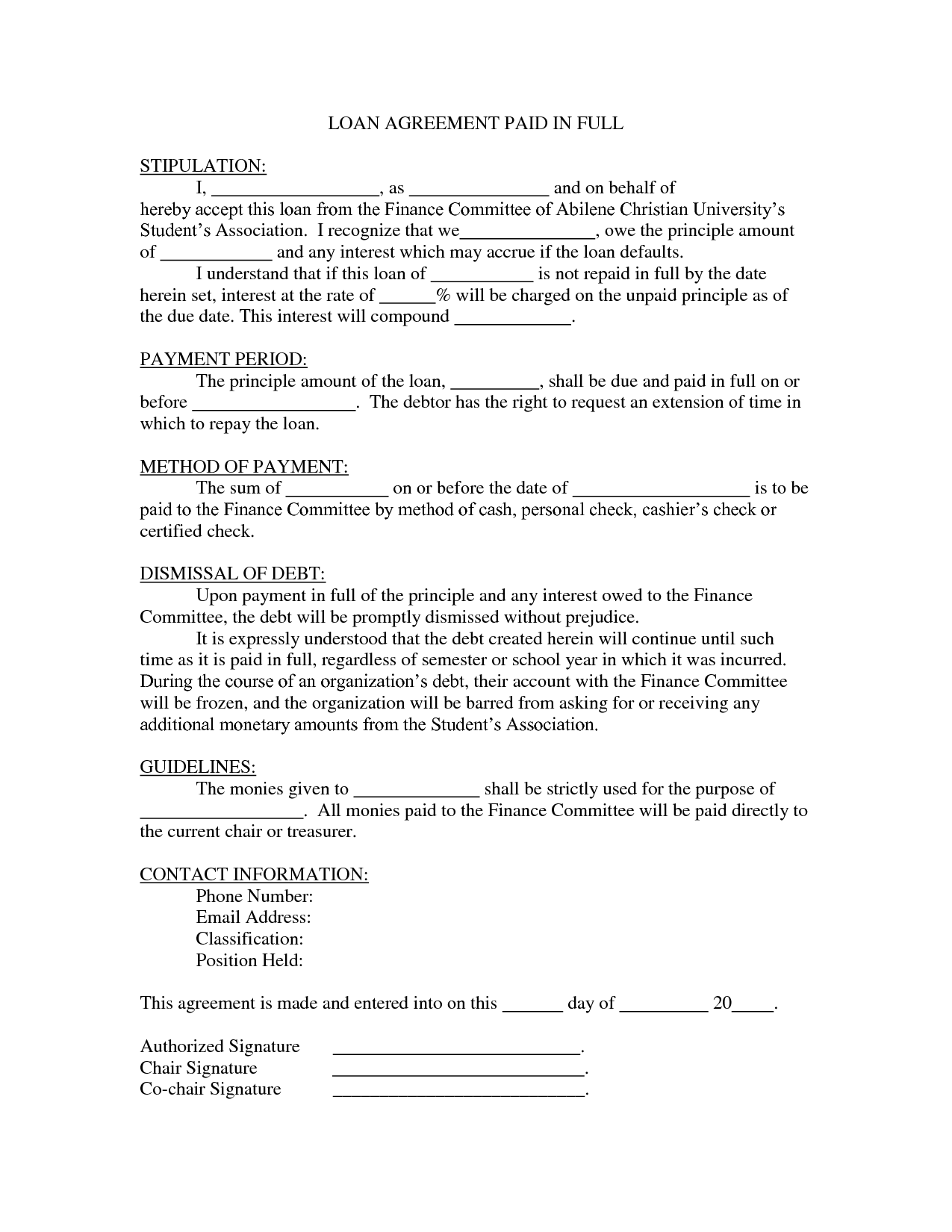

Paid in Full Letter from your Previous Provider

Please contact your previous provider and request from them a paid in full letter or email. We need confirmation that your previous advance with them has been fully paid.

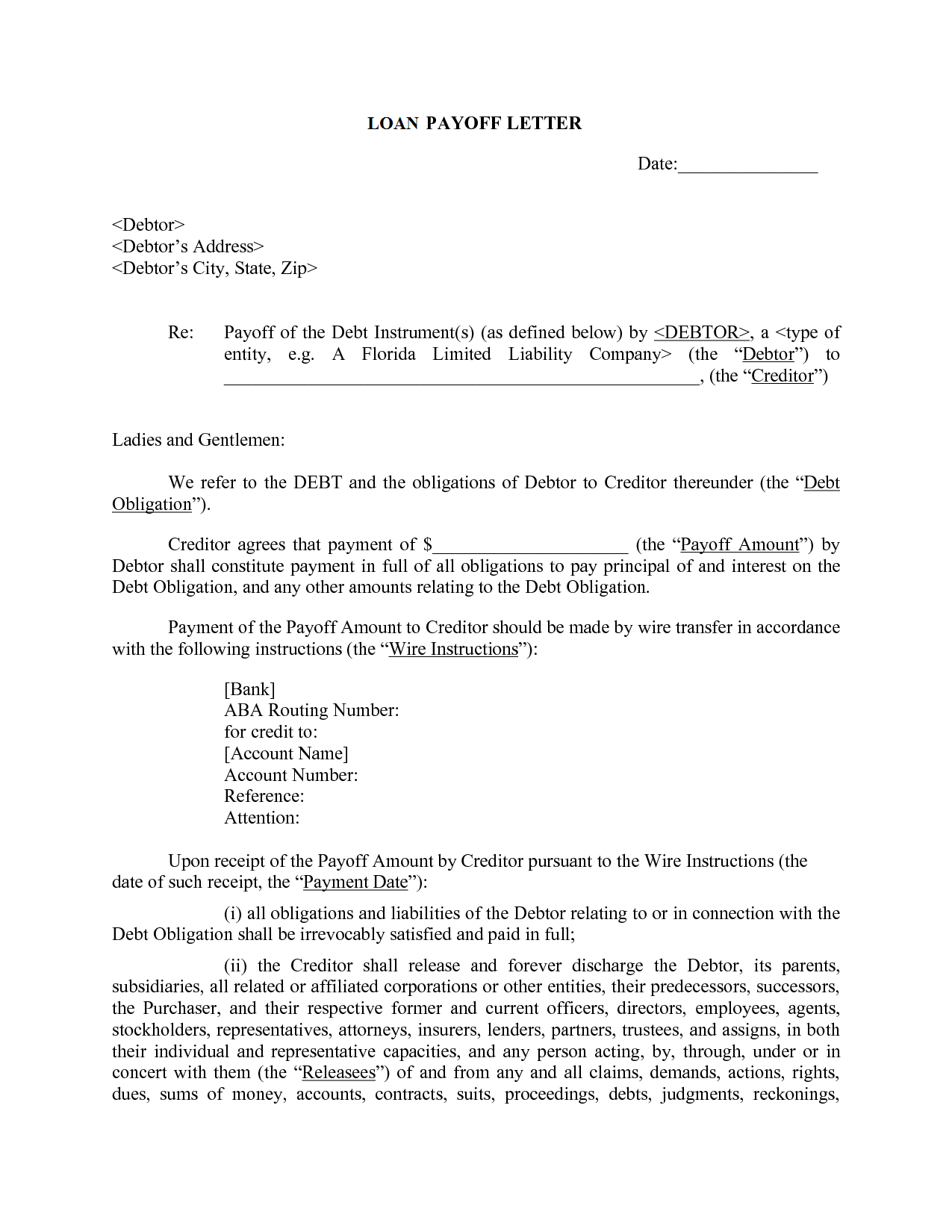

Payoff Letter from your Current Provider

Please contact your current provider and request a payoff letter for your open advance with them. Make sure they include with the letter their wiring instructions, we will pay them off directly from your proceeds.

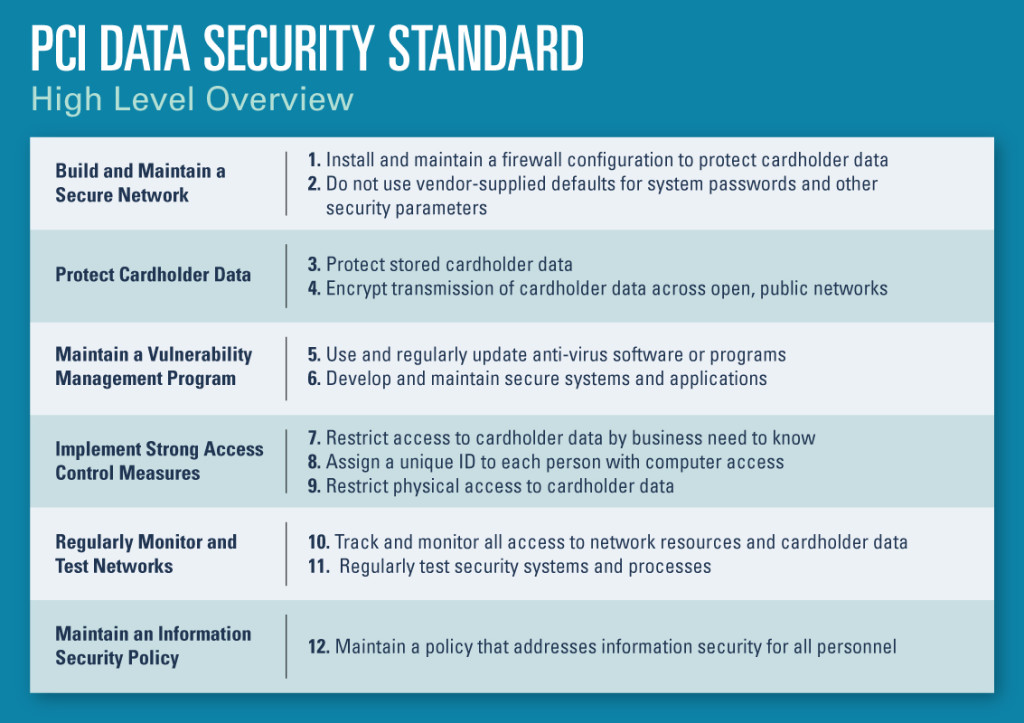

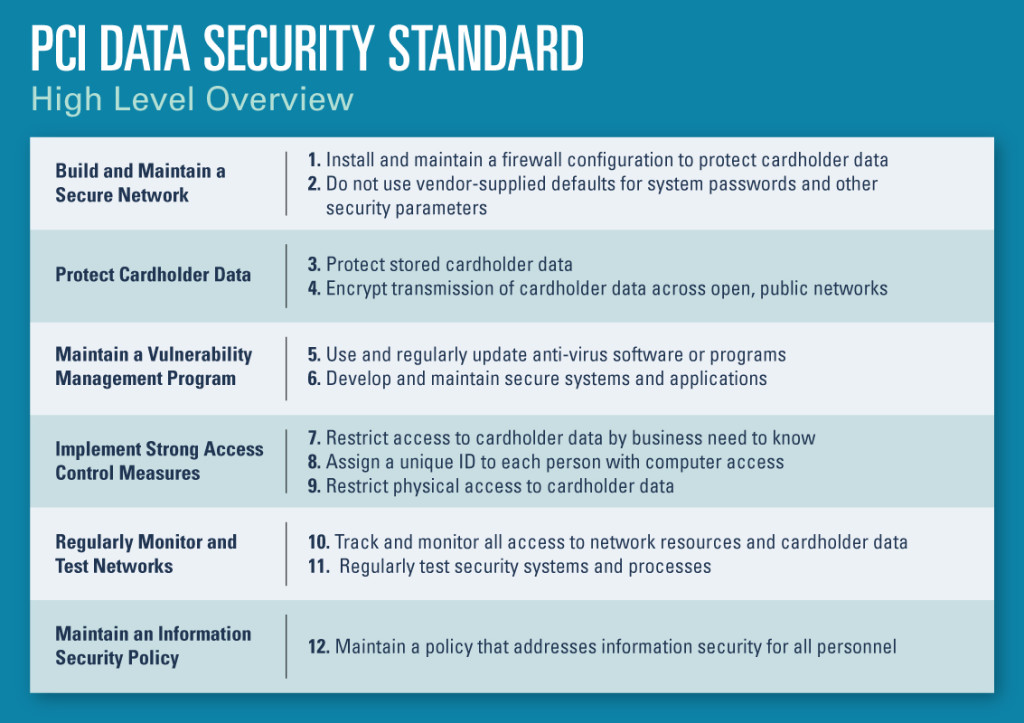

PCI Compliance

Payment card industry (PCI) compliance is adherence to a set of specific security standards developed to protect card information. If you are unsure about your PCI compliance, please contact your Merchant Service Provider.

Permission to Release

The permission to release form is a document you sign on behalf of your business which gives us permission to contact all the references you provided on your working capital application.

Professional Fees

This document is in regards to professional fees related to the transaction of locating and securing working capital for your business.

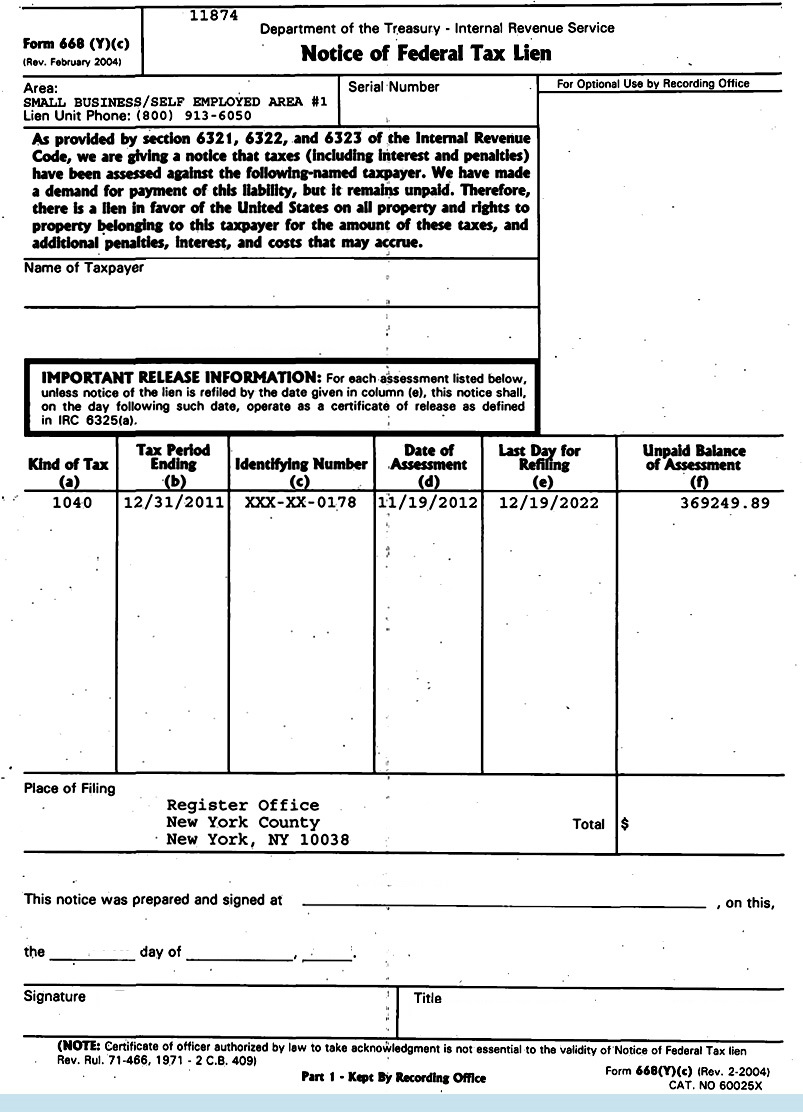

Tax Lien Payment Plan and/or Documentation Related To

Please provide us with a copy of your payment plan for the tax lien(s) listed. We also accept copy of check payments made towards the tax lien. If you don’t have a payment plan in place, please provide an explanation of how you are addressing the matter.

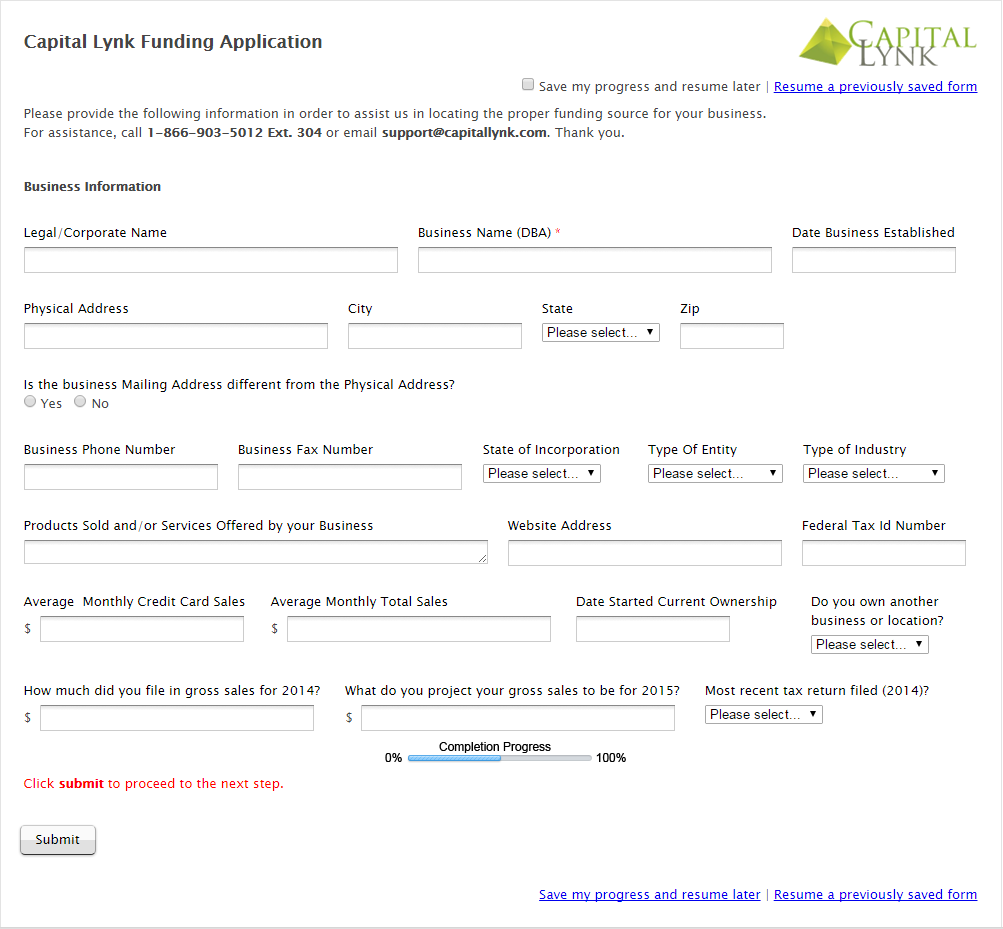

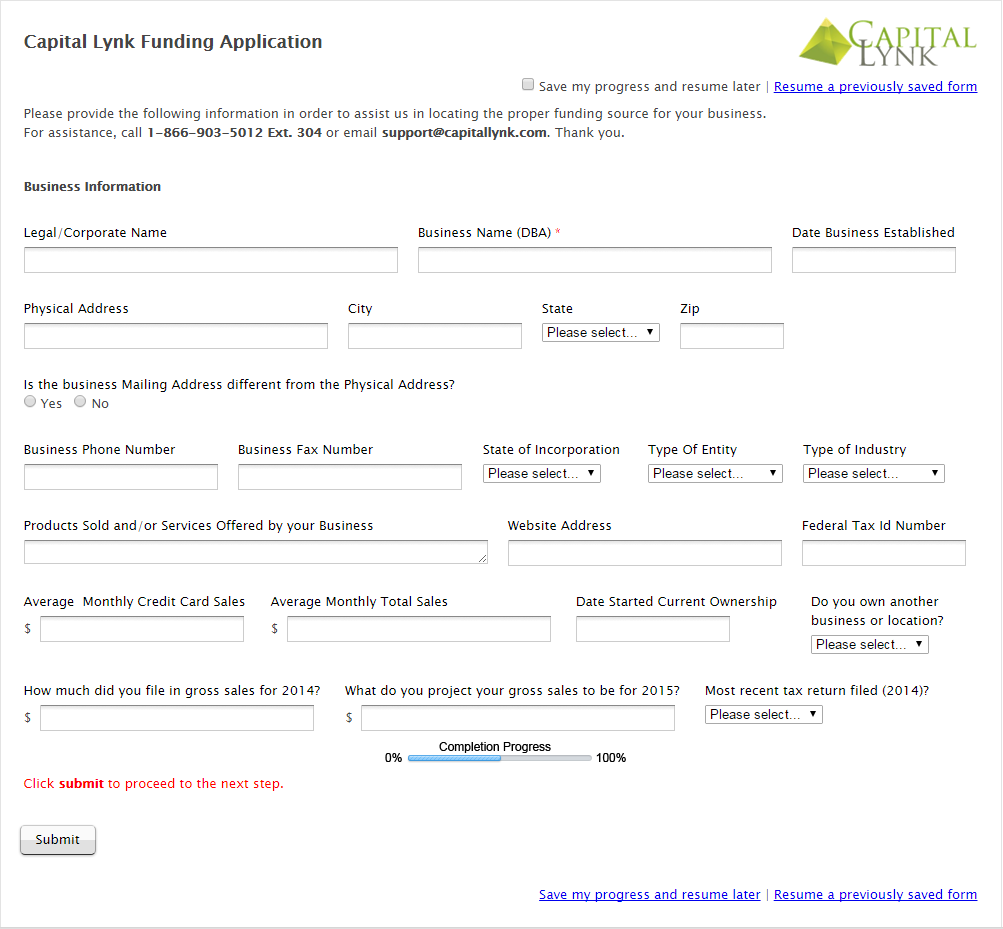

Working Capital Application

To complete your working capital application: Click Here.

Complete your working capital online or by fax. We need information such as your business legal and DBA name, business address, telephone number, federal tax identification number, state of incorporation, description of products and/or services offered, owners personal information. You can click here to complete online or download a copy and fax it back to us. Please note that we need a completed application to process your working capital request and disburse funding.

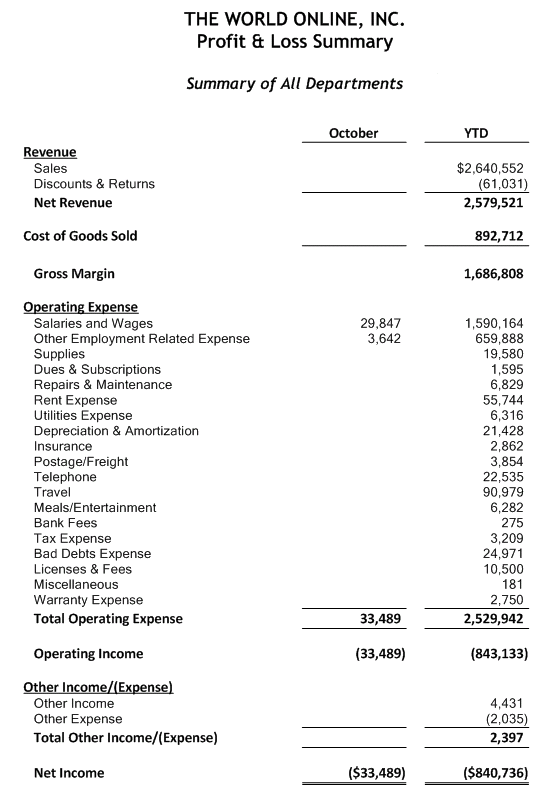

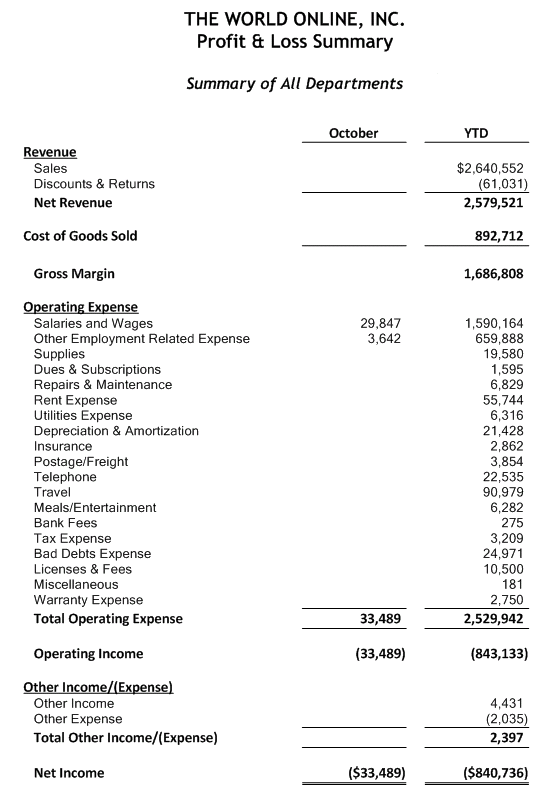

YTD Financials (Include Profit & Loss and Balance Sheet)

A year-to-date financial statement for the business. We would like it to include gross sales revenue, receivables, payables and earnings. We need it to evaluate your company’s financial health. Please note that you can extract it directly from any accounting software that you need or request a copy from your accountant.

Other Documents

For any other assistance relating to required documents, please call us at 1-866-903-5012 Ext. 304.